The Baltic Exchange: Bulk report - Week 29

The Baltic Exchange: Bulk report - Week 29

Capesize

The Pacific market this week was marked by overall sluggishness, experiencing limited activity. The presence of two out of the three major players failed to stimulate trading volumes, leading to stagnant and lacklustre market conditions. Rates in the Pacific have continuously declined throughout the week, reflecting the subdued demand and limited fixture activity. Today’s market activity has shown a slight correction in rates, with a few fixtures concluding at slightly improved levels.

In contrast to the Pacific, the Atlantic market has experienced a slightly higher level of activity, primarily driven by the South Brazil and West Africa routes to the Far East. However, despite this modest increase in activity, the market faced difficulties in gaining momentum or making any significant progress. Throughout the week, freight rates have come under pressure, although, as the week comes to an end, brokers have observed signs indicating that the market is gradually stabilising, suggesting that it may be beginning to establish a more balanced level and a notable clear out of tonnage.

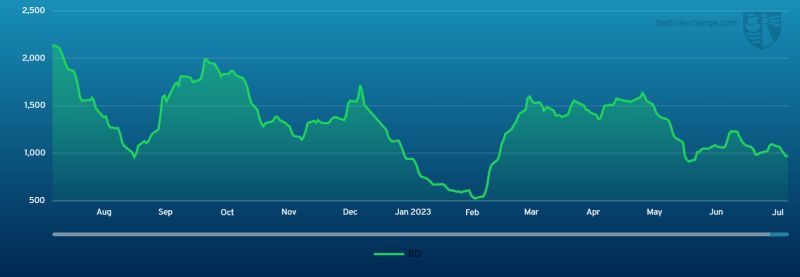

Panamax

The Panamax market provided further losses this week and is showing little signs of abating. Despite a steady level of activity, this failed to stem the tide with both basins yielding sizeable losses. The Atlantic saw rates erode for a further successive week, as pressure from the nearby and committed ships continued to underpin the market. From East Coast South America, the focus this week was on mid-August arrival with the APS load port rates now hovering around the $14,000 + $400,000 mark, but limited support to end the week. Asia similarly witnessed another week of falls. A lack of demand on the longer round trips remained the nemesis to an already weak market. There were reports midweek of an 82,000-dwt delivery Japan achieving $8,750 for an Australian round trip, but activity remained light as the market drifted. Like previous weeks, older and smaller units tended to soak up much of the Indonesia coal demand.

Ultramax/Supramax

A mixed week for the sector with the Asian arena leading the way. The Atlantic generally remained positional throughout, with the US Gulf being the only relatively stable region despite slightly lower levels of enquiry as the week progressed. From Asia, the demand for Indonesian coal remained, which helped rate levels to remain fairly reasonable. However, a lack of support from the NoPac kept rates in check and readily available tonnage. In the Atlantic, a 52,000-dwt was heard to have been fixed for a trip to EC Mexico at $12,500. Elsewhere a 54,000-dwt fixed a trip from Spain to Morocco with grains at $9,500. From Asia, a 56,000-dwt open Indonesia fixed a trip to China in the mid $10,000s. Further north, a 55,000-dwt fixed from North China to SE Asia at $5,000. Elsewhere, a 55,000-dwt fixed a trip delivery Bin Qasim redelivery Madagascar at $6,750 for the first 33 days and $10,750 thereafter.

Handysize

With summer fully underway, it was a week of limited activity across both basins. In the South Atlantic, whilst prompt activity was said to have remained restrained, there was optimism that August would bring some positivity to the region as levels of enquiry were said to improve. A 39,000-dwt was fixed from Santos to Morocco at $11,500 and a 37,000-dwt fixed from Rio Grande to Venezuela with an intended cargo of paddy rice at $13,500. Meanwhile a 40,000-dwt fixed from San Lorenzo to Santos at $8,500. On the Continent a 36,000-dwt fixed from Rostock to the US Gulf with an intended cargo of grains at $5,000 and a 34,000-dwt fixed from Grenaa to Icdas with an intended cargo of scrap at $5,250. In Asia, a 38,000-dwt was fixed from Geelong via Western Australia to China with an intended cargo of grains in the high $8,000s whilst a 38,000-dwt was fixed from Kuantan via Indonesia to Taiwan at $6,300.